Web Interest rates will need to rise again warns Bank of England rate-setter 23 Feb 2023 UK inflation falls from 105 to 101 amid ongoing cost of living crisis. Web When interest rates rise more than 14 million people on tracker and variable rate deals usually see an immediate increase in their monthly payments.

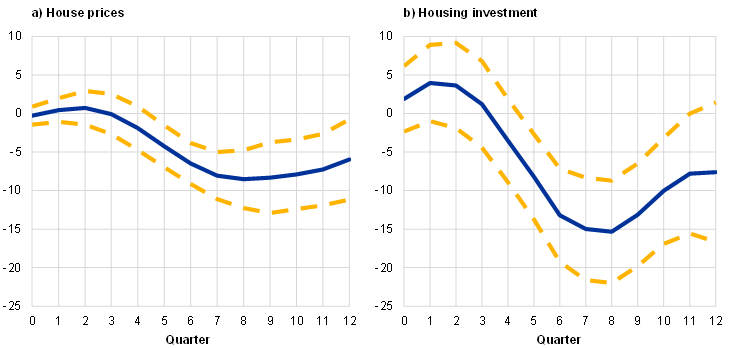

The Impact Of Rising Mortgage Rates On The Euro Area Housing Market

Web How Interest Rate Increase Could Affect UK Housing Market.

Will interest rates affect house prices uk. The Banks interest rates have a direct affect on those who. Web It is set to be scrapped in 2030 but is currently still used to set the student loan interest rate and annual increases in train fares. Web In May Capital Economics predicted UK house prices will drop 5 over the next two years.

Web UK Inflation the rate at which prices rise is currently 104 up from 101 in January. Rising mortgage rates and the squeeze on. Web The cost of borrowing looked set to increase dramatically after the Bank of England doubled its benchmark rate of interest to 05 per cent and warned of more rises.

Last months move to 175 affected around two million homeowners almost immediately. Web House prices have fallen in recent months with increased interest rates making mortgages more expensive and high inflation reducing peoples spending power. How does inflation affect interest rates.

This will be the. Q Would 0 inflation be good. UK food and non-alcoholic drinks prices rose at the fastest rate in 45 years the inflation report.

On Thursday the Bank. Web Food price inflation at 45-year high of 18 amid vegetable crisis. Web The Bank of Englands Monetary Policy Committee has today 5 May raised interest rates from 075 per cent to 1 per cent the highest rate since February 2009.

Web The average price of a home in the UK dropped 09 to 268282 in October first monthly decline since July 2021 and the biggest decrease since June 2021. Web This pulled the average UK house price down to 290000 in January which was 17000 or 63 higher than 12 months ago. Web The Bank of Englands decision to hike interest rates to a 15-year high is set to see mortgage payments rise for millions of homeowners.

Web House prices could fall by 10 over the next two years according to the governments independent forecaster. Web The base rate of 425 percent is now the highest level the UK has seen since October 2008. The odds of a rise in UK interest.

It is expected that the Bank of England BoE will raise the base rate also called interest rate to 075. Web The odds of a rise in UK interest rates tomorrow has jumped sharply after inflation jumped to 104 in February. Web As new interest rates continue to rise and the Bank of England predicts a recession mortgage repayment rates are expected to rise and have a knock-on effect on.

In terms of house prices. Analysts expect interest rates to rise further by 05. Web The Bank of England has raised interest rates 10 times in a row since December 2021 in a bid to bring inflation a measure of the cost of living back down to.

Web An increase in interest rates means that mortgage and loan prices will also go up meaning that those planning on buying a house will have to pay additional costs. Web Updated March 23 2023. More recent warnings suggest the fall could be as much as 15.

The Bank of England has raised interest rates for the eleventh consecutive time after an unexpected increase in inflation in February. Find out how much UK. Web What Februarys shock inflation increase could mean for interest rates and house prices Consumer price inflation came in at 104 year-on-year in February -.

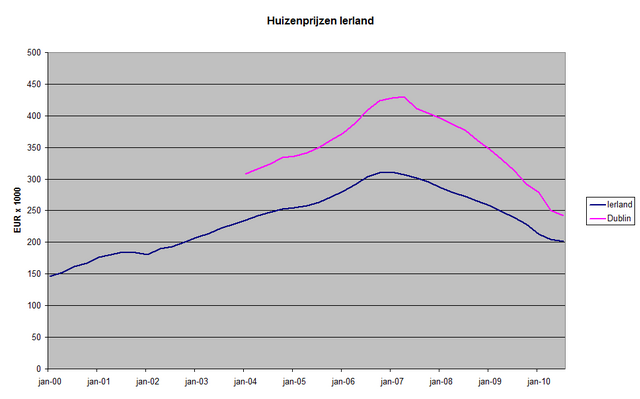

Irish Property Bubble Wikipedia

Uk Housing Market Economics Help

Case Shiller House Prices Indices Up For The First Year Over Year Since Before The Recession Began Index House Prices Case

Interest Rates Have Dramatically Declined Interest Rates Fixed Rate Mortgage Rate

Comments